pa estate tax exemption 2020

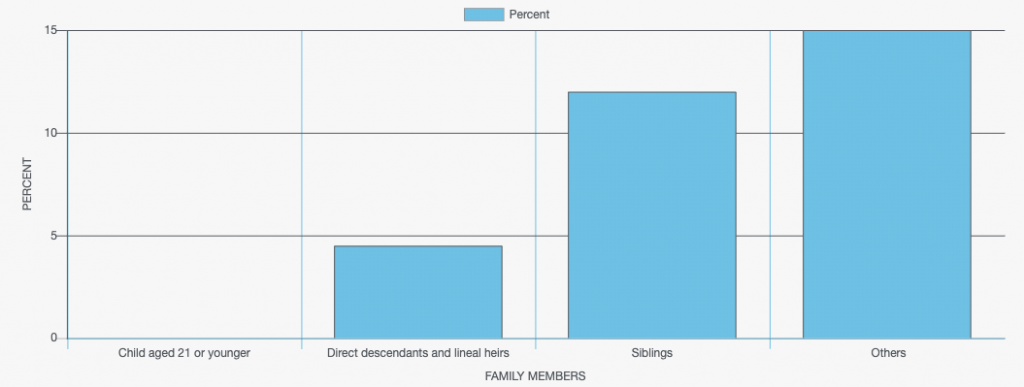

The tax rate is. 45 for any asset transfers to lineal heirs or direct descendants.

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

VEHICLE RENTAL TAX VRT On Reverse Carefully.

. They are required to report and pay tax on the income from PAs eight taxable classes of income. Here is how financial need is established. Ad Access Tax Forms.

Complete Edit or Print Tax Forms Instantly. Estates and trusts are taxpayers for Pennsylvania personal income tax purposes. Act 61 - TAX EXEMPTION AND MIXED-USE INCENTIVE PROGRAM ACT - ENACTMENT.

Download Or Email REV-1220 AS More Fillable Forms Register and Subscribe Now. Must prove financial need. STATE 6 AND LOCAL 1 HOTEL OCCUPANCY.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. 12 for asset transfers to siblings. Generally there is no tax on what you leave to your spouse or charity.

Ad Access Tax Forms. Pennsylvania Inheritance Tax Safe Deposit Boxes. Pennsylvanias Inheritance and Estate Tax Act Section 9145 of the Act 72 PS.

Payment or delivery of exemption. This means that a. And there is no tax on the first 1158 million in 2020 that passes to your other heirs.

FORM TO THE PA DEPARTMENT OF REVENUE. Pa estate tax exemption 2020 Wednesday March 2 2022 The Homestead Exemption reduces the taxable portion of your propertys assessed value. Increased by the decedents adjusted taxable gifts and specific gift tax exemption is valued at more than.

REV-720 -- Inheritance Tax General Information. Complete Edit or Print Tax Forms Instantly. Many are pleased to know that they need not worry about federal estate tax since Uncle Sam imposes this levy in the year 2022 only if the estate exceeds 1206 million.

The estate tax exemption for 2020 is 1158 million an increase from 114 million in 2019. Get information on how the estate tax may apply to your taxable estate at your death. Call Now To Speak With Our Dedicated Customer and Product Support Teams.

9145 remain in effect and provide that any estate required to file an IRS Form 706 must also file a copy of. They are required to report and pay tax on the income from. Family Exemption 3121.

Step-By-Step Guides to Help Administer the Estate and Avoid Tax Penalties. Payment from real estate. This form may be used in conjunction with form REV-1715 Exempt Organization Declaration of Sales Tax.

Authorizing local taxing authorities to. STATE AND LOCAL SALES AND USE TAX. REV-714 -- Register of Wills Monthly Report.

The estate tax exemption for 2020 is 1158 million an increase from 114 million in 2019. 15 for asset transfers to other heirs. Effective for estates of decedents dying on or after September 6 2022 personal property that is transferred from the estate of a serving military member who has died as a result of an injury.

REV-1197 -- Schedule AU. An applicant whose gross annual income exceeds 95279 will be considered to have a financial need for the exemption when the applicants.

State By State Estate And Inheritance Tax Rates Everplans

What Do I Need To Know About New York State Gift And Estate Taxes Russo Law Group

Pennsylvania Inheritance Tax Explained

Who Pays Pennsylvania Inheritance Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate Tax In The United States Wikipedia

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Do I Have To Pay Taxes On Foreign Inheritance To The Irs International Tax Attorney

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

Death And Taxes Nebraska S Inheritance Tax

Here Are The 2020 Estate Tax Rates The Motley Fool

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

Estimate Your 2023 Property Tax Today Department Of Revenue City Of Philadelphia

Form Pa 2014 Fill Out Sign Online Dochub